Custom tax rates allow you to specify the rates you want to charge for sales tax in countries and regions in which you are required to collect and remit sales tax.

We cannot advise you which countries and regions those are. Generally for USA based artists, you must collect and remit sales tax in the state where you live. In some cases in other states as well. Please discuss the matter with a tax professional.

When you enable custom tax rates, they will take precedence over any other methods you are using to collect taxes (such as setting up your tax rates in paypal).

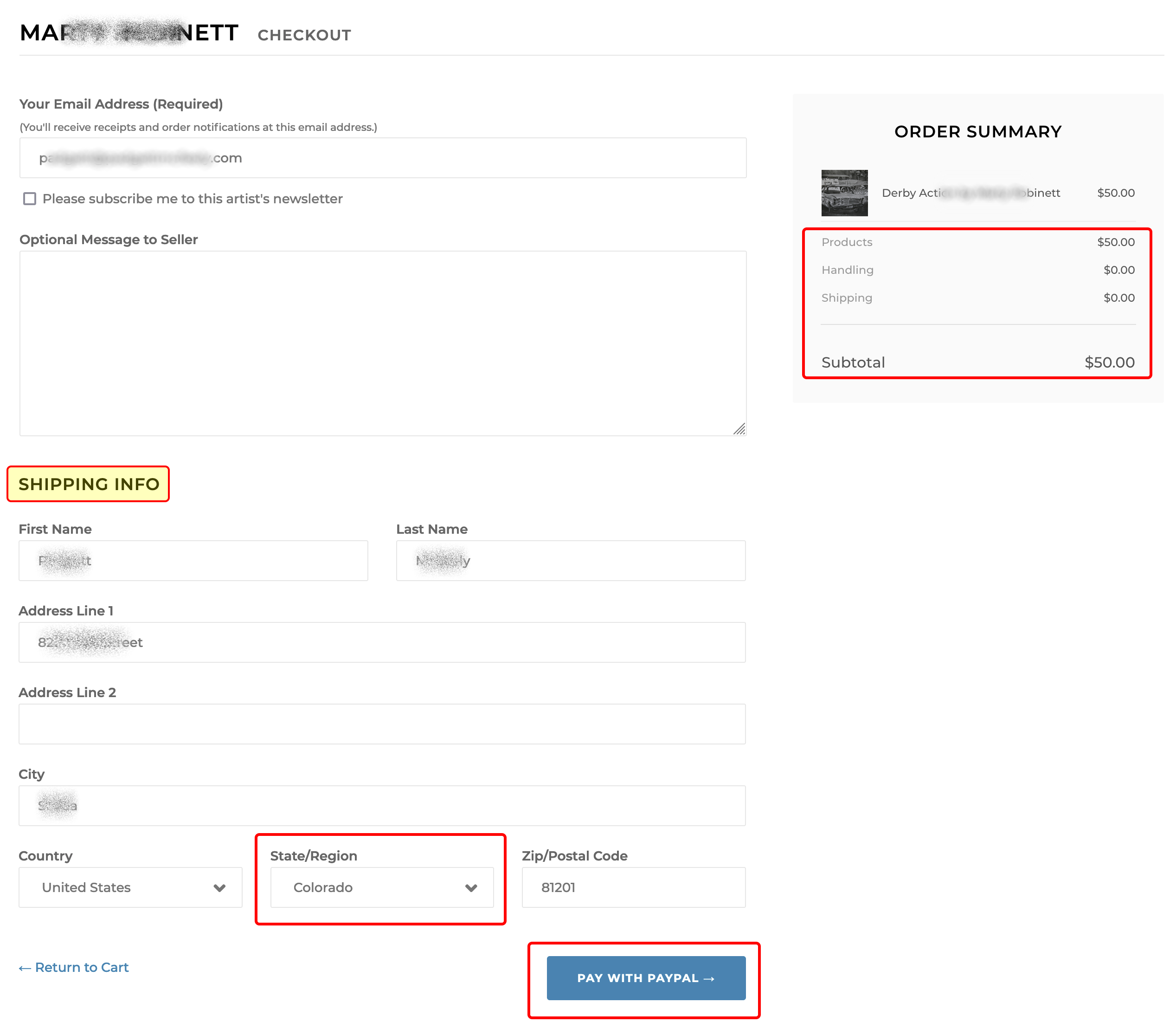

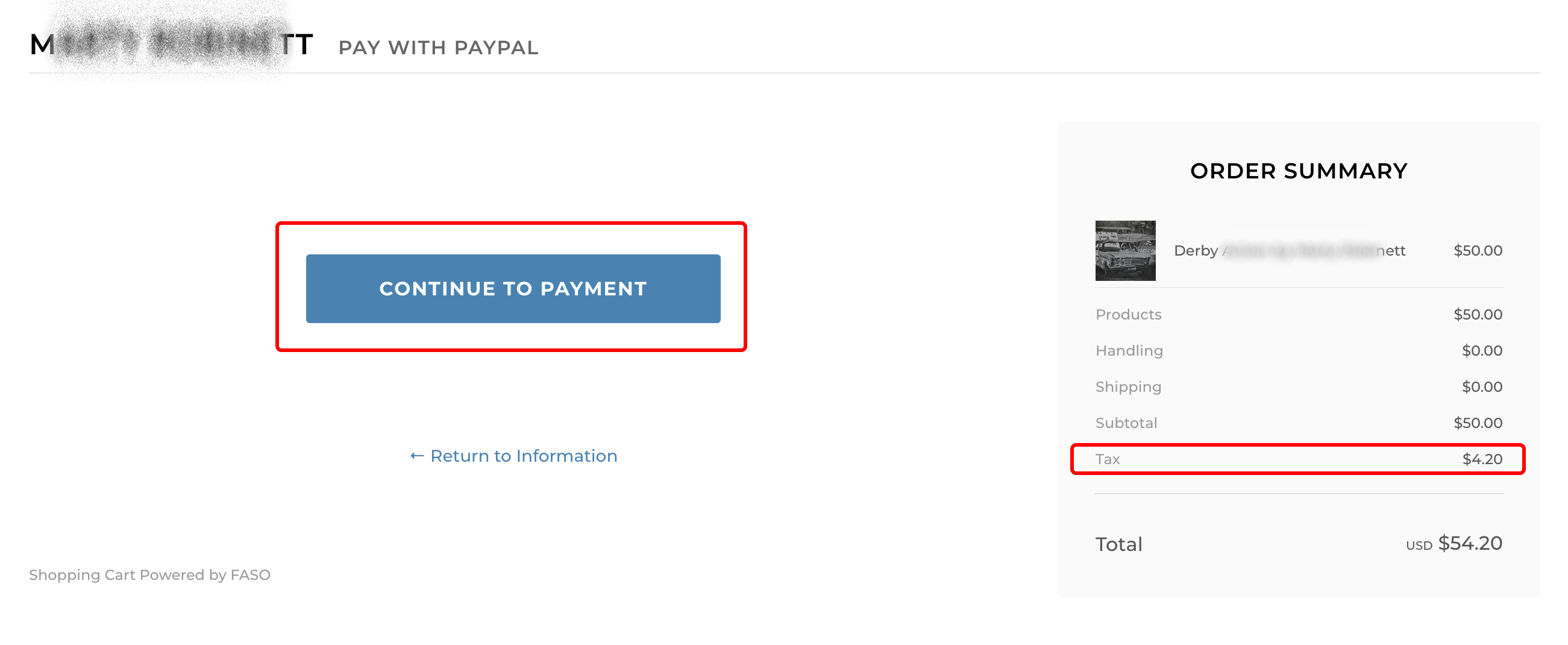

The tax will be shown in the shopping cart as the user checks out.

To set up a custom tax rate:

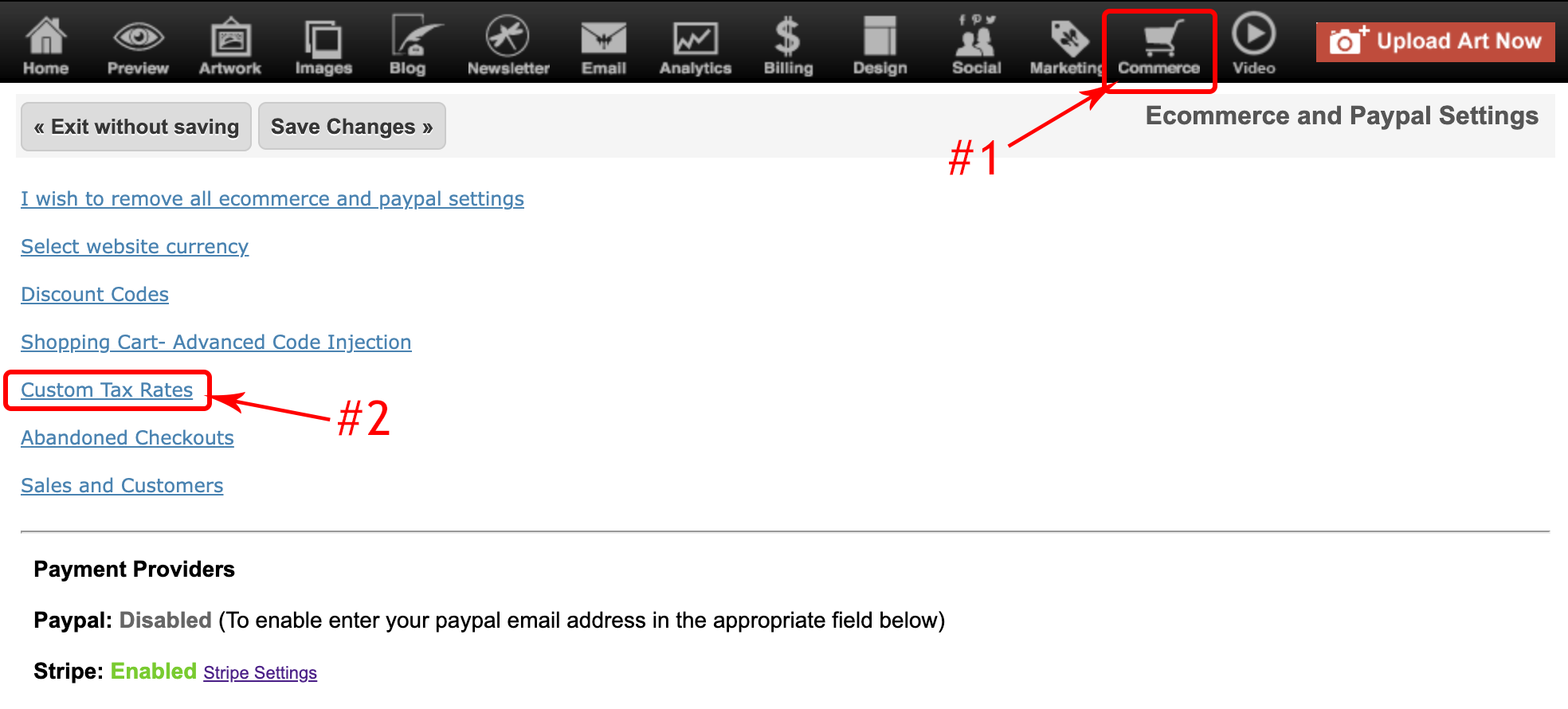

- from FASO control panel

- click Commerce icon (upper row)

- click Custom Tax Rates

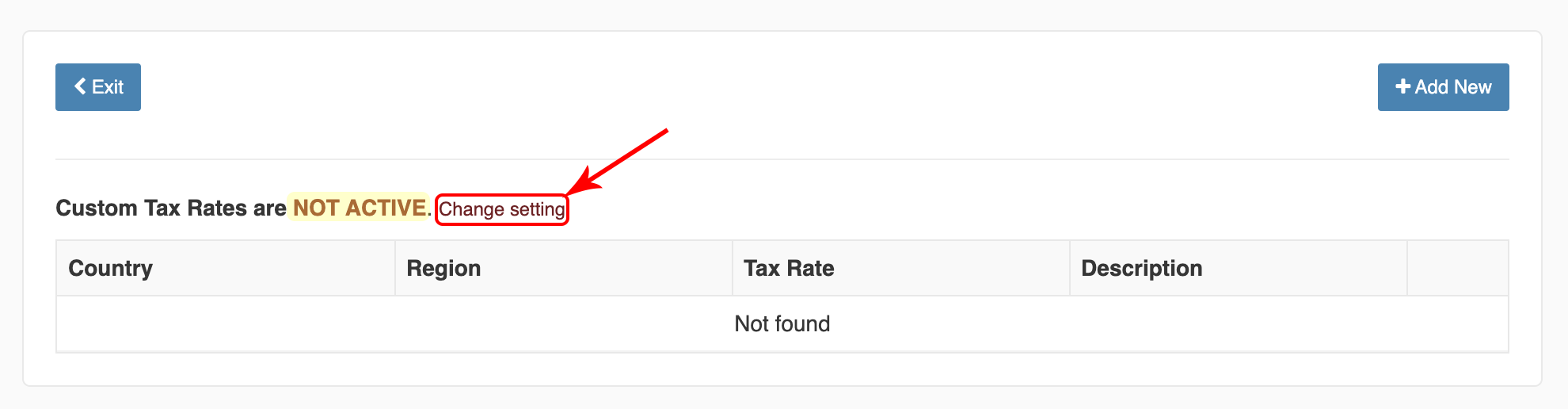

- click Change setting

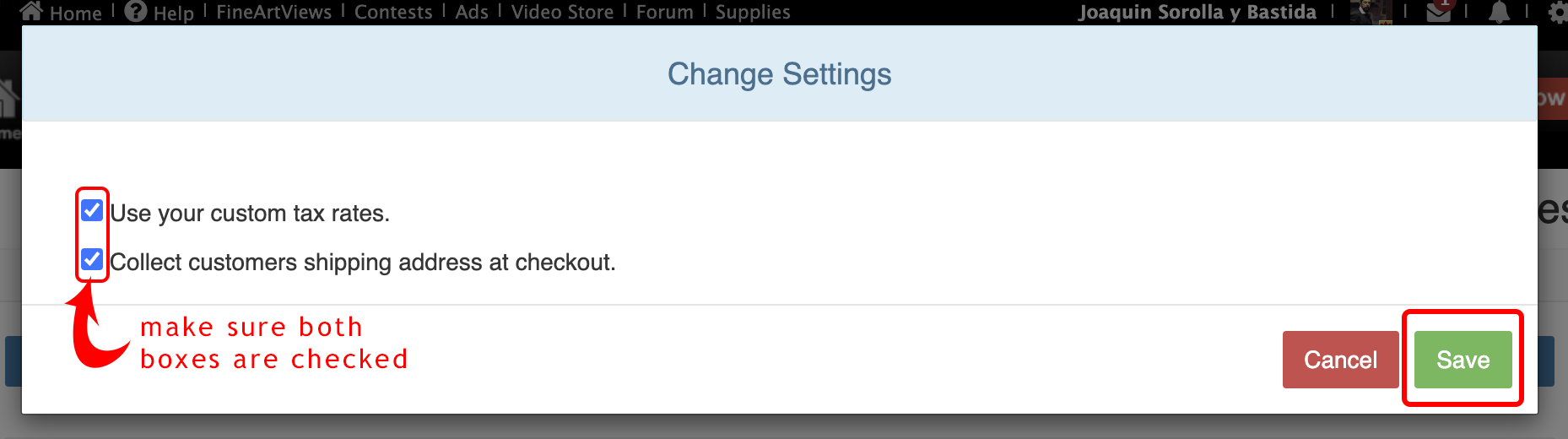

- check BOTH boxes

Both pieces of information are needed to calculate if the tax rate needs to be charged.- the first check box enables the custom tax rates

- the 2nd checkbox tells the shopping cart to start collecting the customer's shipping address at the time of checkout

- click Save

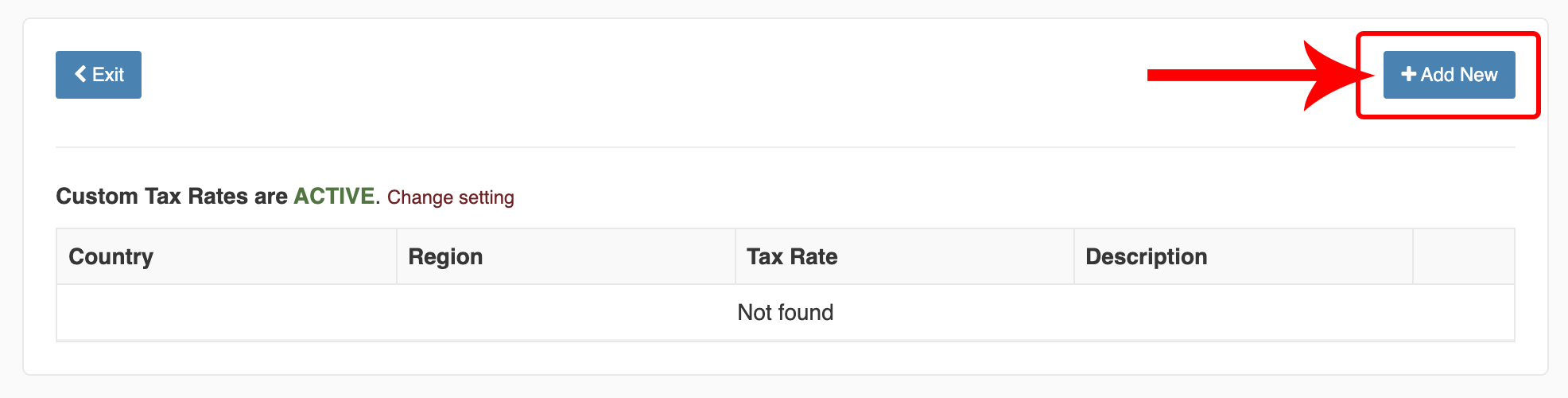

- To add a custom rate, click Add New

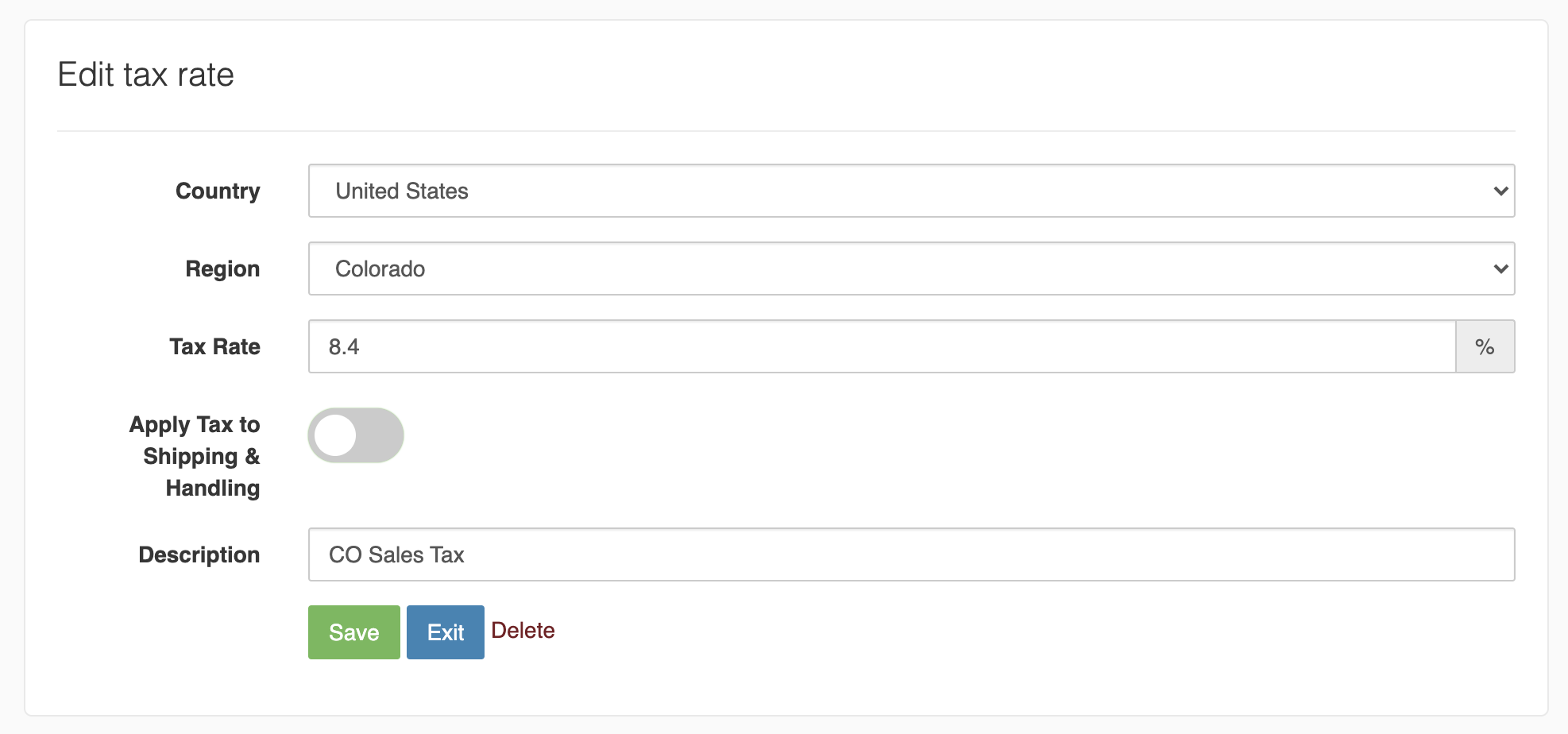

- use the dropdown arrows to select Country and Region (State).

- enter tax rate

(do NOT add a dollar sign or other currency designation - numbers and decimals only) - enter description

- click Create

NOTE: if you wish to apply the sales tax to any shipping and handling charges you have set up, be sure to turn on Apply Tax to Shipping & Handling. |

Tax will be shown in the shopping cart as the user checks out. Screenshot examples:

Note: Sales Tax will not be added to a video that has been uploaded using the FASO Video feature. During the checkout process there is no option to select a shipping address since the video is for streaming purposes only, hence no sales tax. |

03032025